10 Best Affordable Los Angeles, CA Suburbs to Live in 2023

Table Of Content

A recognizable suburb of Los Angeles is Bellflower, where the home prices are almost $230K less than in Los Angeles. Bellflower has about 79,000 residents and is a great suburb to consider moving to, offering you access to many Southern California staples. From the Hollywood Sports Paintball & Airsoft Park to The Los Angeles County Fire Museum, you’ll be close to what makes Bellflower unique. Mortgage rates started ticking up from historic lows in the second half of 2021 and increased dramatically in 2022 and throughout most of 2023.

Why You Should Consider Buying Below Your Budget

What Income Do I Need To Afford a $500K House? Crunching the Numbers To Get Your Keys - Newsweek

What Income Do I Need To Afford a $500K House? Crunching the Numbers To Get Your Keys.

Posted: Tue, 09 Apr 2024 07:00:00 GMT [source]

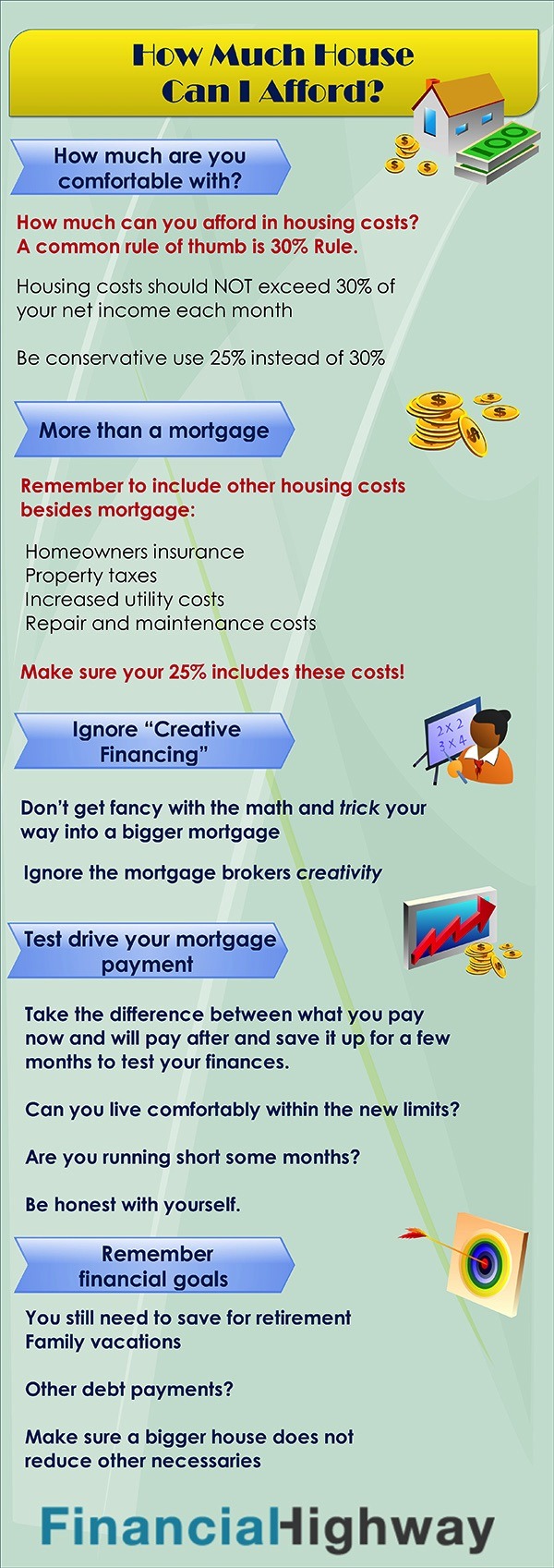

Ideally, you’ll want to avoid spending more than a third of your gross monthly income on your mortgage. However, depending on your finances, you may be able to afford a slightly more expensive home. According to the 29/41 rule, you should spend no more than 29% of your gross income on housing and no more than 41% of your gross income on the sum of all debt payments, housing included. We’ll see what that looks like in a moment, but let’s first discuss how to calculate your DTI. However, just because you’re approved for a certain amount doesn’t mean you should buy a house with that home price.

Fun-Filled Things to Do in San Clemente, CA if You’re New to the City

Homeowners with a 15-year mortgage will pay approximately 65% less mortgage interest as compared to a homeowner with a 30-year loan. Miranda Crace is a Senior Section Editor for the Rocket Companies, bringing a wealth of knowledge about mortgages, personal finance, real estate, and personal loans for over 10 years. Miranda is dedicated to advancing financial literacy and empowering individuals to achieve their financial and homeownership goals. She graduated from Wayne State University where she studied PR Writing, Film Production, and Film Editing. Her creative talents shine through her contributions to the popular video series "Home Lore" and "The Red Desk," which were nominated for the prestigious Shorty Awards.

How does credit score impact affordability?

Your mortgage lender typically holds the money in the escrow account until those insurance and tax bills are due, and then pays them on your behalf. If your loan requires other types of insurance like private mortgage insurance (PMI) or homeowner's association dues (HOA), these premiums may also be included in your total mortgage payment. Make sure your mortgage payment (principal, interest, property taxes and homeowners insurance) is no more than 29% of your gross monthly income. Also make sure your total monthly debt (mortgage plus car loans, student debts, etc.) is no more than 41% of your gross monthly income. The first number in the 29/41 rule, 29, represents your housing expense ratio.

Explore the best places to buy a house based on home values, property taxes, home ownership rates, housing costs, and real estate trends. A mortgage calculator can help you determine how much house you can afford. Play around with different home prices and down payment amounts to see how much your monthly payment could be, and think about how that fits in with your overall budget.

Three Homebuyers' Financial Situations

Los Angeles, California is an iconic city, and probably the first city that comes to mind when you think of California. Don’t fret, there are plenty of affordable Los Angeles suburbs to consider house hunting in. To comfortably afford that mortgage, a household must bring in about $222,132 annually. Yet, the median household in the state earns $91,551 – only about 41% of the income required to afford the home. With 10% down, a 30-year-mortgage, and an interest rate of 7.22%, Clever's analysis showed first-time buyers must earn $119,769 to comfortably afford a median-priced home ($332,494).

The table above shows a comparison of 30-year vs. 15-year fixed-rate loans for a $250,000 home with a 20% down payment. The monthly payments for the $200,000 mortgage includes homeowners insurance and property taxes for Kansas City, Missouri. And don’t forget you’d also need to pay a down payment and closing costs upfront, while keeping enough leftover to cover regular maintenance, upkeep and any emergency repairs that may arise. Sometimes called “real estate taxes,” property taxes are typically billed twice annually. Along with homeowners insurance, property taxes can be paid in equal installments along with your monthly mortgage payment.

Property listings

FHA loans have more lax debt-to-income controls than conventional loans; they allow borrowers to have 3% more front-end debt and 7% more back-end debt. The reason that FHA loans can be offered to riskier clients is the required upfront payment of mortgage insurance premiums. The 28/36 Rule is a commonly accepted guideline used in the U.S. and Canada to determine each household's risk for conventional loans.

Down Payment

Use the affordability calculator to see how your down payment affects your home affordability estimate and your monthly mortgage payment. An FHA loan is government-backed, insured by the Federal Housing Administration. FHA loans have looser requirements around credit scores and allow for low down payments.

According to the data, a median home in California sells for $798,854. After a 20% down payment, the monthly mortgage payment costs about $5,183, or $62,197 annually. If you are taking out a conventional loan and you put down less than 20%, private mortgage insurance will take up part of your monthly budget.

The down payment is an essential component of home affordability. Bankrate’s mortgage calculator can help you explore how different purchase prices, interest rates and minimum down payment amounts impact your monthly payments. And don’t forget to think about the potential for mortgage insurance premiums to impact your budget. If you make a down payment of less than 20 percent on a conventional loan, you’ll need to pay for private mortgage insurance, or PMI.

When lenders assess whether or not you can afford a mortgage loan, they’ll compare your estimated PITI with your gross monthly income (income before taxes and deductions). When determining your home buying budget, consider your entire PITI payment rather than only focusing on principal and interest. If taxes and insurance are not included in a mortgage calculator, it’s easy to overestimate your home buying budget. If you get a $200,000 mortgage with a 15 year fixed rate at 5%, your monthly payments will be $1,582 (excluding taxes and insurance). When lenders evaluate your mortgage application, they calculate your debt-to-income ratio (DTI). This is the sum of your monthly debt payments divided by your monthly gross income.

Here's how much $ you need to make to afford a home in San Diego, per Zillow - NBC San Diego

Here's how much $ you need to make to afford a home in San Diego, per Zillow.

Posted: Thu, 14 Mar 2024 07:00:00 GMT [source]

If lenders determine you are mortgage-worthy, they will then price your loan. Your credit score largely determines the mortgage rate you’ll get. Down payment & closing costsNerdWallet's ratings are determined by our editorial team.

Let’s go over some of the inputs to our home affordability calculator, plus some extra factors you’ll want to consider. Understanding the difference — and then using a home affordability calculator to crunch some numbers — will help you decide how much house you can really afford. There are several types of home loans, but which one is right for you will depend entirely on what you qualify for and what ultimately makes the most sense for your financial situation.

You’ll need to also consider how the VA funding fee will add to the cost of your loan. Mortgage rates are influenced by market interest rates but ultimately determined by your lender and can be fixed or adjustable. This means they can stay the same or change over the life of the loan. Your rate can be higher or lower depending on your credit score, down payment and other factors. Although your DTI and housing expense ratios are important factors in mortgage qualification, other variables impact your monthly mortgage payment and how much you can afford. On the flip side, if you have a price in mind, you can use a mortgage calculator to see how much cash you’ll need for a down payment and closing costs.

You’ll have a comfortable cushion to cover things like food, entertainment and vacations. We believe everyone should be able to make financial decisions with confidence. Along the same lines of thinking, you might consider holding off on buying the house. A financial advisor can aid you in planning for the purchase of a home.

Comments

Post a Comment